Send money to Nigeria faster, and for less.

Make fast, secure international transfers home.

Terms and Conditions apply.

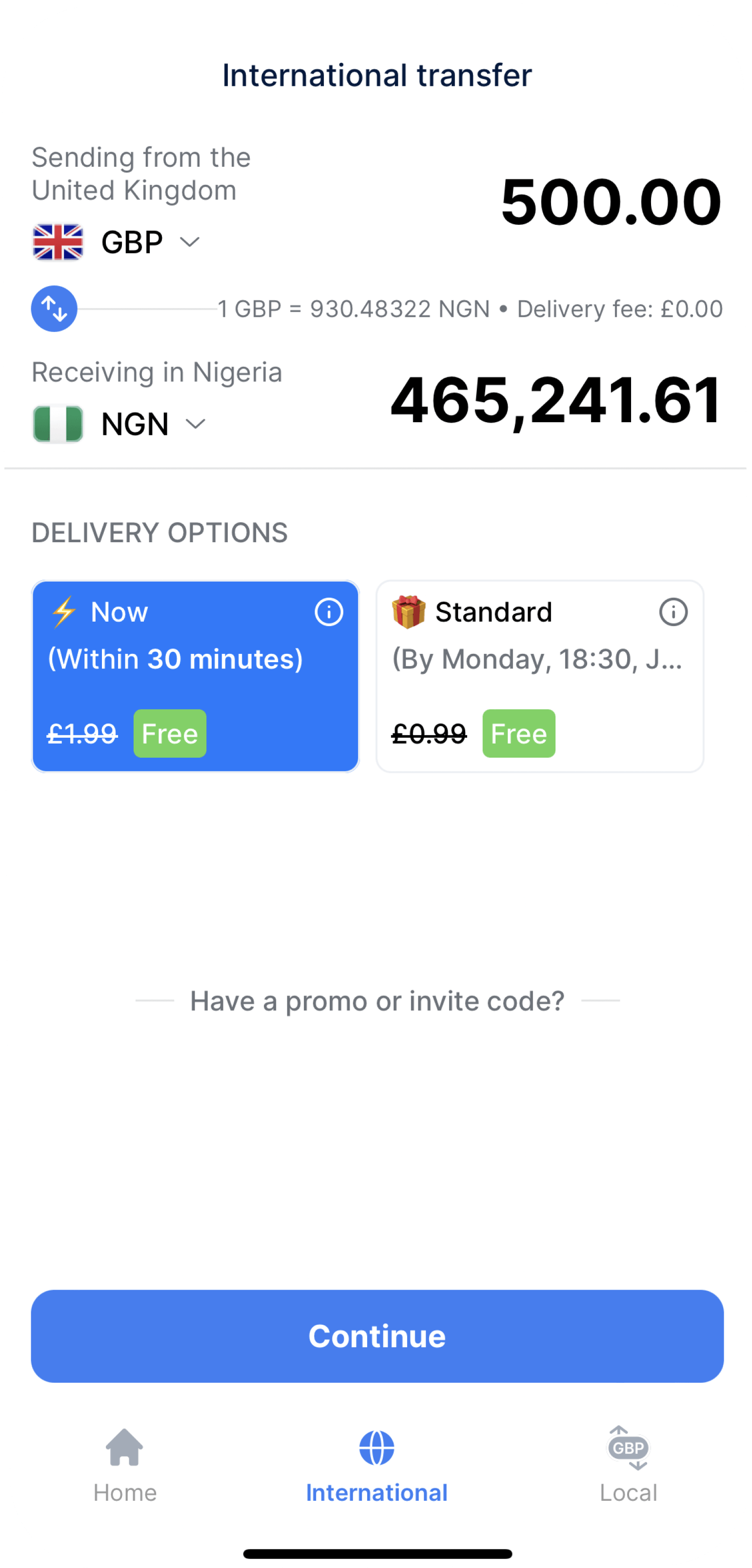

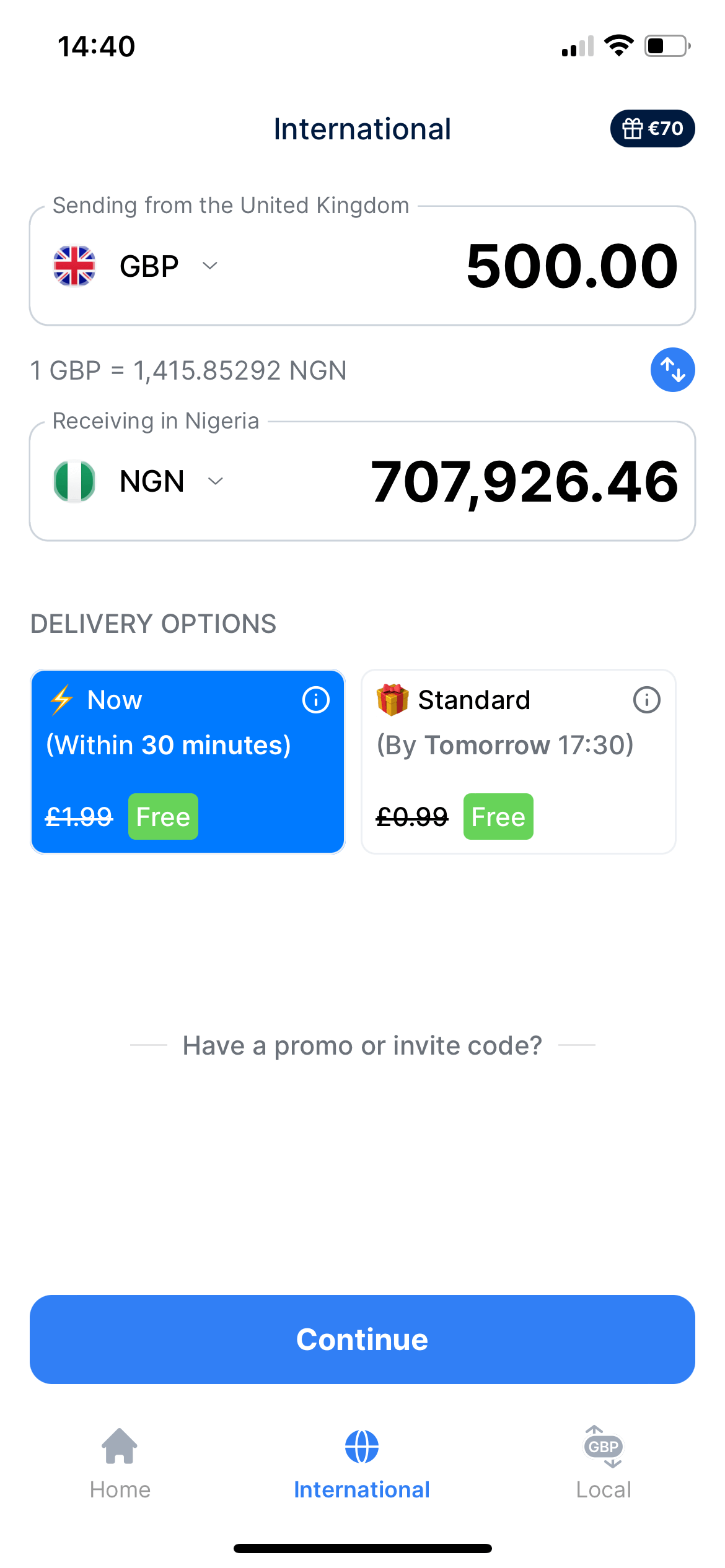

Here’s how much it costs to send money to Nigeria

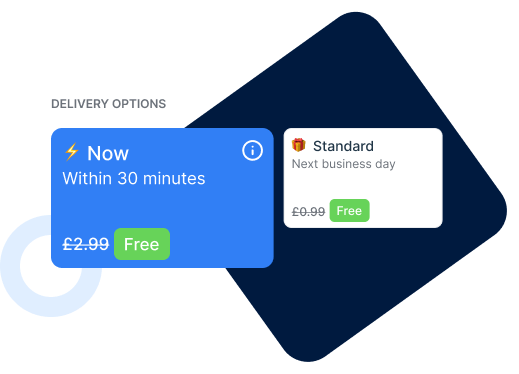

All our transfers to Nigeria are free! Instant card transfers, bank transfers, next day transfers… we add zero fees.

And we don’t hide fees either. The receiver gets the exact amount that our app tells you they’ll get. No hidden fees or no nasty surprises.

How does your money arrive in Nigeria?

Bank accounts

We make local transfers directly from our Nigerian account to your receiver’s bank account in Nigeria, skipping expensive international fees.

Debit/credit card

Or we can put the money straight onto your receiver’s credit or debit card.

It’s as easy as 1, 2, 3

Choose how much you want to send, and when

Send from European currencies to Naira and USD in Nigeria

Add the receiver’s details

All you need is their receiver’s full name, bank account number / NUBAN or card details

Choose your payment method—and make the transfer!

Pay in by bank transfer or by card: the exchange rate stays the same

Rest assured

Here’s why you can trust us with sending your money to Nigeria

Don’t take our word for it…

Here’s what our users say about sending money home to Nigeria…

The cheapest

way to make

real-time money

transfers

Pay family, friends and bills back home—

whichever way you suits you best.

How to get started…

What information do I need to make money transfers to Nigeria?

How long does it take to send money to Nigeria?

Our fastest option is instant—which means it arrives in a few minutes. You can also make next day transfers if you prefer, but all our transfers to Nigeria are free at the moment—so why wait?

Best ways to send money to Nigeria

Bank transfer

Bank transfers are a popular option for funding your international money transfer. They take a little longer than debit or credit card transfers but they’re insanely cheap.

Debit card

Paying with a debit card makes your money transfer super-fast. However, compared to a bank transfer, it can be more expensive as they’re charged at a higher (but still low) fee.

Credit card

You can also pay for your international money transfers with a credit card. TransferGo accepts both Visa and Mastercard to make transfers super simple.

PISP

Some money transfers are enabled by a third-party financial entity called Payment Initiation Service Provider, or PISP, which facilitates direct bank transfers for seamless online transactions.

SWIFT

When funds are processed, payment institutions use Society for Worldwide Interbank Financial Telecommunication (aka Swift), a global messaging network that secures and executes cross-border transactions.

Apple Pay

If Apple Pay is enabled on your phone, you can use your mobile wallet to send money to certain countries. It’s quick and easy but check with your bank first in case they charge you extra fees.

Google Pay

Prefer to use Google Pay? If you have your mobile wallet set up, you can send money to certain countries using Google Pay. All you need is your receiver’s mobile number.

Frequently asked questions (FAQs)

The best way to send money to Nigeria

Real-time money transfers with a mobile app are the fastest, easiest way to send money to Nigeria (or any destination country around the world). Most of them are free to download, are up to 90% cheaper than banks, and are regulated by serious institutions like the Financial Conduct Authority. Some apps, like TransferGo, have outstanding Customer Service in several languages for when users need support. You can find our phone number and email address on our support page.

How to send money from the UK to Nigeria

If you’re sending from a credit/debit card, you just use the TransferGo app to send money to a card or bank account in Nigeria. Choose the currency you’re sending from and to, your receiver’s full name and card details, and then your own details.

If you’re making a bank transfer, start your order in the TransferGo app, then use your own banking app to send TransferGo the money—using the bank details they send you. Once you’ve done that, let TransferGo know in the app, and they’ll send the money to your receiver in Nigeria.

How to send money from Europe to Nigeria?

It’s the exact same process as sending money from the United Kingdom. Simply open the TransferGo app, choose your currencies, add your receiver’s details, and then input your own. You can do the whole process within the TransferGo app—unless you’re making a transfer from your bank account, in which case you’ll need to use your banking app to pay in the money to our account.

Can I send money to Nigeria with a bank?

Yes, you can, but it’s cheaper to use TransferGo—even if you’re sending from your bank account. Why? Because with TransferGo, your money doesn’t actually cross borders. You make a bank transfer to our account in the United Kingdom, and TransferGo pays your receiver from their account in Nigeria. This can save up to 90% on traditional bank transfer fees.

With TransferGo you can also send money from one card straight to another in Nigeria, and it’s almost instant. The functionality is extremely intuitive and allows you to complete transfers in under a minute.

The cost of international money transfers to Nigeria

Transfers to Nigeria with TransferGo are free. That’s why many Nigerians in Europe and the UK use TransferGo’s money transfer services for remittances.

The advantages of sending money to Nigeria with TransferGo

TransferGo money transfers are free, and can be performed in a few simple steps without the hassle of visiting a bank. Compared with other digital money transfer apps, TransferGo is cheaper and always has favourable currency exchange rates. They also have fast, friendly Customer Support in English and 9 other languages, which provides guidance and peace of mind when you need it.

The safe way to send money to Nigeria online

Online money transfers are safe, as long as:

1) You use a safe and protected money transfer providers like TransferGo. Established money transfer companies are regulated by EU and UK laws, and monitored by serious regulators like the Financial Conduct Authority. They use the highest possible security to keep your money safe. If transfers ever do get cancelled, they’ll return your money to you immediately.

2) You only send money to people you know and trust. Once your money has been sent to someone, no one can get it back. So beware of fraudsters and be sure of who you’re sending money to.

Which money transfer companies to trust

Look for well established brands that have proper websites, terms and conditions, and tens of thousands of Trustpilot reviews. For example, TransferGo has over 30,000 verified reviews and a total score of 4.8 out of 5 on Trustpilot, which lets you know that the company is legitimate.

How long it takes for your money transfer to reach Nigeria

Delivery times can vary, but card transfers are instant, taking a few seconds, or 1-2 minutes at the most. Bank transfers usually arrive within 30 minutes. You can also choose to send them within 24 hours, but the fees are the same (zero), so why wait?

How your receiver gets the money in Nigeria

Each destination country differs. In Nigeria, the money you send will arrive directly on people’s cards or into their bank accounts, depending on which payout option you choose. In other countries in Africa, like Ghana, recipients can also receive the money on their mobile wallet, or as cash pickup from a partner outlet.

The maximum amount you can transfer to Nigeria

International money transfers to Nigeria vary in size. We can’t reveal any specific limits, as these depend on our payment partners in Nigeria.

How to track the status of money transfers to Nigeria

We’ll always keep you updated on your transfer status. Just check your home screen in the app (whether’s it’s Android or iOS.)

How to transfer money with low fees to Nigeria

Your best bet is to use TransferGo—our fees to Nigeria are currently zero! That includes charges, admin fees, delivery fees and so on.

The quickest method for sending money to Nigeria

The fastest way is to use a money transfer app like TransferGo. We get your money to your receiver’s bank account in Nigeria in less than half an hour—usually just 2 or 3 minutes!

The process of ordering the transfer is also super easy. If you’ve verified your ID and you know your recipient’s bank details, you can order the transfer in seconds.