TransferGo Business:

Pay. Save. Receive. Exchange.

Manage your cash flow in more than one currency? Work with overseas suppliers, employees or clients? Looking to grow your savings in a free account with zero-penalty withdrawals?

No matter your size, industry or location, there’s a TransferGo business service suited to your needs.

Global money management, made easy

No two businesses are alike—that’s why our business solutions are designed to flex to your unique setup.

International business payments

Send from

Exchange Rate

– – –

GBP 1 = NGN 2030.28232

Transfer Fee

Free – – – 0.99 0.99 USD

Receiver gets

Powered by Moka United

Delivered in minutes

International

business payments

Make regular cross-border transactions? Our transfers are reliable, straightforward and profit friendly.

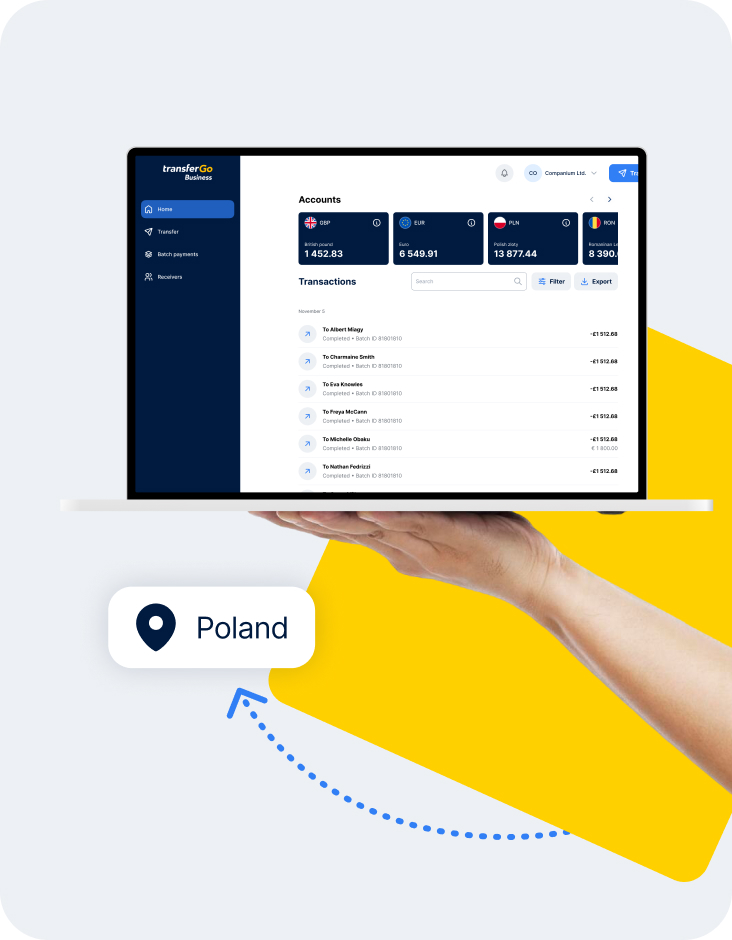

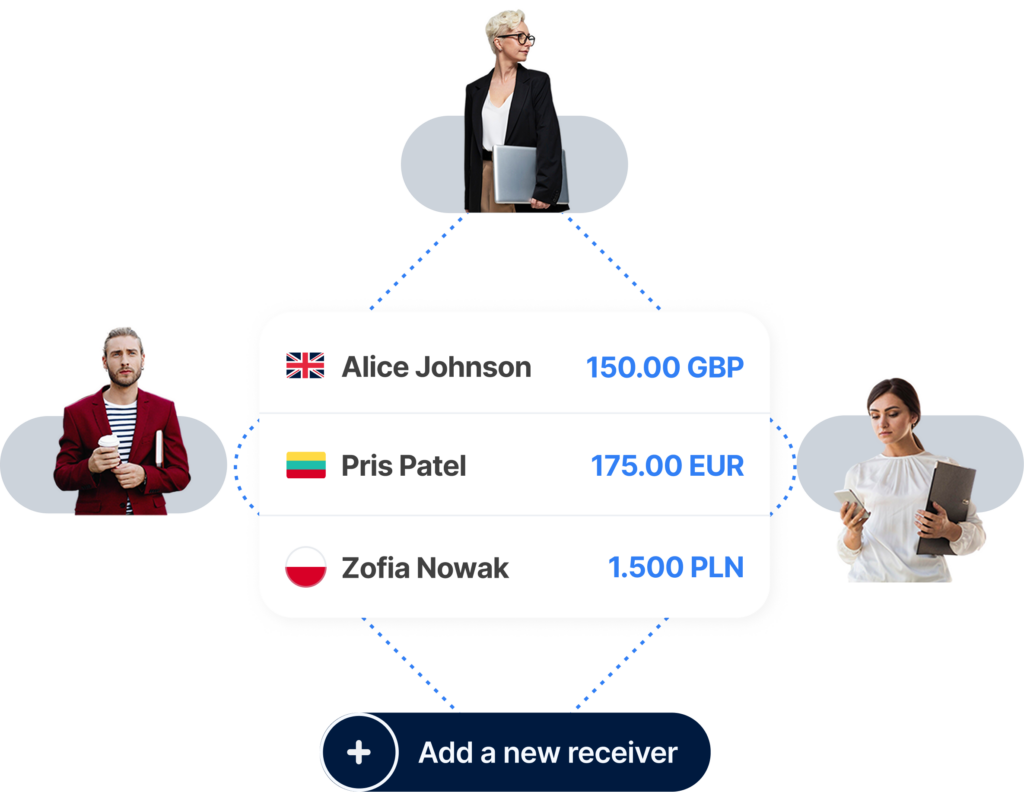

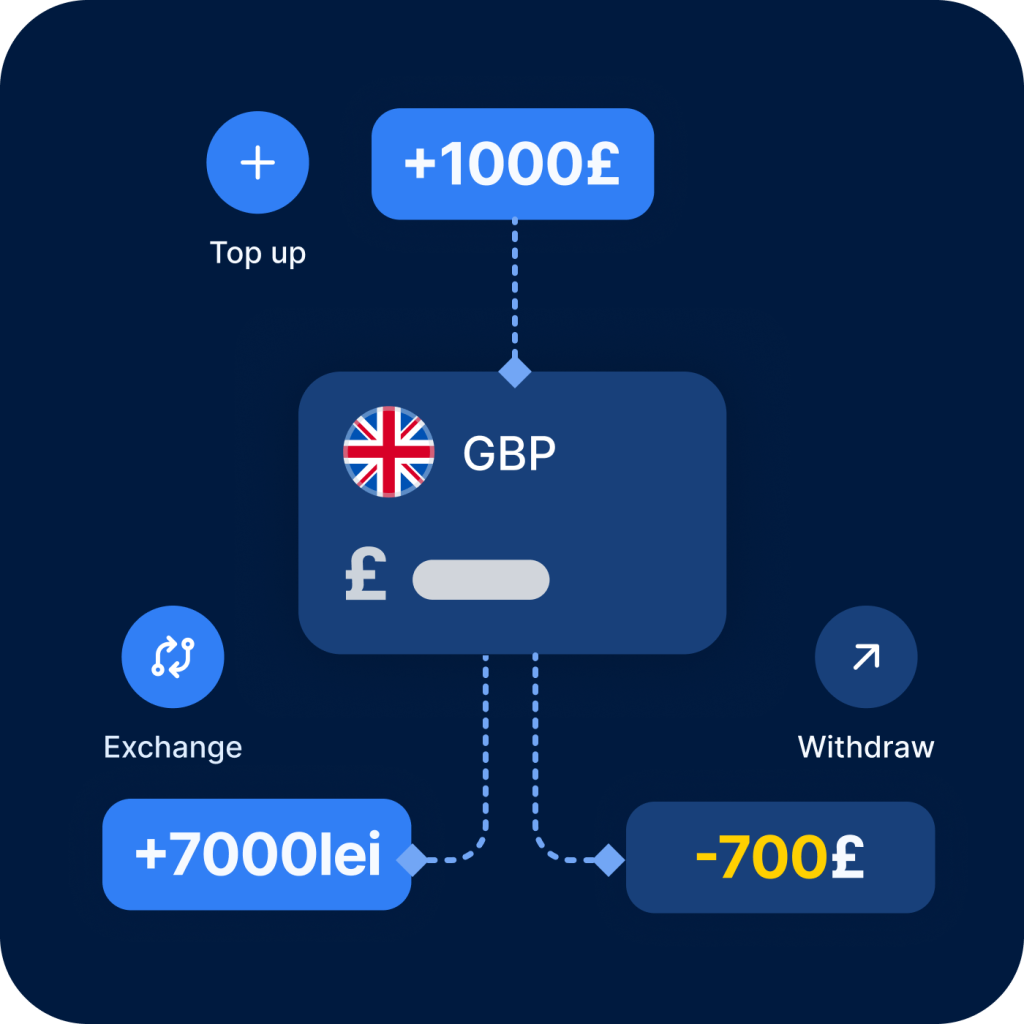

TransferGo Business Account

TransferGo

Business Account

Send and receive international payments, manage and exchange currencies—plus more—with our free business account.

Easy-access savings account

Easy-access

savings account

With daily interest, zero-penalty withdrawals—and no minimum opening balance—there’s a lot to love about our savings account*.

This feature is only available to businesses in the UK (for now–wider availability is on the way).

Get more out of your

global money transfers

Our 12 years of global-payment expertise are at your fingertips. Pay suppliers, contractors and employees—or move money between your subsidiaries—quickly, easily and cost effectively.

Keep growing with a TransferGo business savings account

No conditions, no complexities. With our easy-access savings account, your funds are always building—and always within reach, whenever you need them.

This feature is only available to businesses in the UK (for now–wider availability is on the way).

Advantageous interest rates

Get daily interest at competitive AER, paid out monthly—maximising the value of every pound you save.

Zero-penalty withdrawals

Withdraw money, move it between accounts or convert currencies without impacting your interest rate.

No fees, no minimum deposit

Forget setup and maintenance fees—our savings account is entirely free. Plus, there’s no minimum opening amount, meaning you can start saving from just £1.

First-class service for every business

From sole traders with big ambitions to multinational organisations navigating diverse markets, we’re here to help you grow both your profit and your global presence.

Spread the word

With end-to-end encryption, safeguarding measures, strict adherence to EU and UK regulations—plus more—we keep your money safe, every step of the way. Curious about how it works?

Tips and tools for business growth

Want industry updates, insights and more?

Frequently asked questions

What is TransferGo Business?

TransferGo Business is our online platform dedicated to companies like yours. We provide business users with a fast and easy way to pay international suppliers and send money abroad. Business international payments with TransferGo are quick, secure and trustworthy, and we keep the fees low.

How can a TransferGo business account benefit small businesses?

Just like personal money transfers, TransferGo makes sending money to a business account simple and straightforward. All you need to do is sign up (it’s free), verify your identity and account details and follow the prompts to pay with your chosen payment method.

You can register and make a business account or business payments with TransferGo via our website.

Is my money secure with TransferGo?

TransferGo Business is completely safe and secure. We’re FCA regulated, meaning your money is safeguarded until payout. And, in the rare event a transfer doesn’t go through, a full refund is guaranteed through our trusted partners.

Other state-of-the-art security measures include: a strong anti-fraud team; robust onboarding controls; two-factor authentication and rigorous transfer screening.

Is TransferGo right for my business?

If you ever need to make or receive international payments, or handle more than one currency—you stand to benefit from using TransferGo Business.

Is TransferGo a bank?

No, TransferGo’s a financial technology company that provides individuals and businesses with a range of services, such as international money transfers, multi-currency accounts and currency exchange.

*Easy access savings accounts are provided by Griffin Bank Ltd (”Griffin”). Griffin is a company registered in England and Wales (No. 10842931). Griffin is authorised by the Prudential Regulation Authority (PRA) and regulated by the PRA and the Financial Conduct Authority (FCA). Griffin’s firm reference number is 970920.