Send money abroad faster, and for less.

Download our app to send money abroad in minutes.

Send from

Exchange Rate

– – –

GBP 1 = NGN 2030.28232

Transfer Fee

Free – – – 0.99 0.99 USD

Receiver gets

Delivered in minutes

Rated — Excellent

From reviews on Trustpilot

Multi-currency account.

More than just money transfers

Our multi-currency account has landed—a free-to-use platform from which you can send, receive, hold and exchange a range of currencies. With exclusive in-app FX rates and instant, zero-fee transfers between accounts, it’s set to make your money go even further.

Here’s how much it costs to make a money transfer abroad

Your first 2 transfers are free! After that, our fees stay low. The receiver gets the exact amount that our app tells you. No hidden transfer fees, no nasty surprises.

Download TransferGo app:

Scan to download the TransferGo app

How to send money abroad in 3 simple steps

1

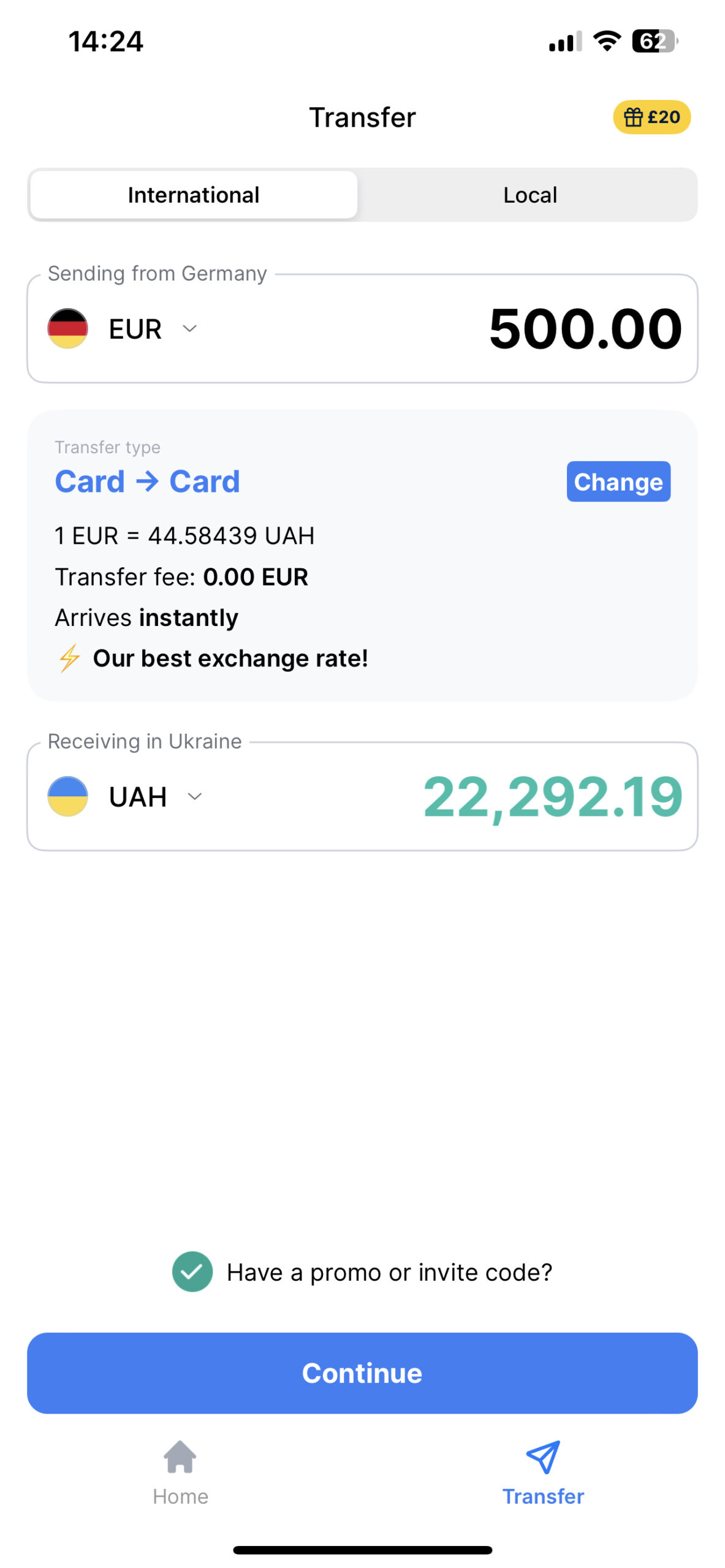

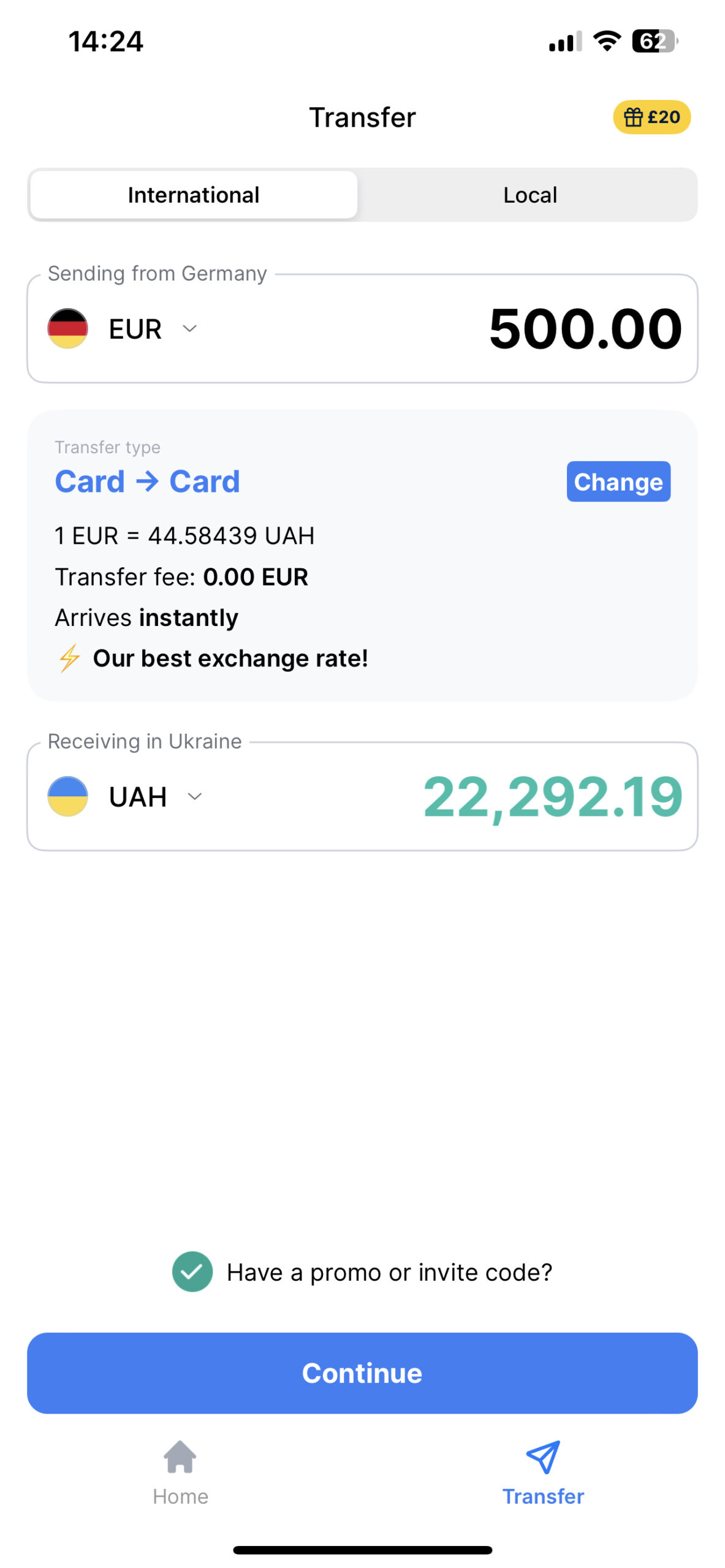

Choose the amount and currency

Select how much you want to send and choose the currency

2

Add the recipient’s details

Enter the recipient’s information to ensure accurate delivery

3

Confirm and send

Review the details and complete your transfer quickly and securely

Secure transfers and dedicated support

Here’s why you can trust us with sending your money abroad

Don’t take our word for it…

How long does it take to send money abroad?

Our fastest delivery times option is instant, which usually arrives in 2-3 minutes. You can also send money overseas the next day, but your first 2 instant money transfers abroad are free right now—so why wait?

Get started with your international money transfer

What information do I need to transfer money abroad?

Make fast, easy money transfers—download the TransferGo app!

Scan to download the TransferGo app

Best ways to send money abroad

Bank transfer

Bank transfers are a popular option for funding your international transfer. They take a little longer than debit or credit card transfers but they’re insanely cheap.

Debit card

Paying with a debit card makes your money transfer super-fast. However, compared to a bank transfer, debit card transfers can be more expensive as they’re charged at a higher (but still low) fee.

Credit card

You can also pay for your international money transfers with a credit card. TransferGo accepts both Visa and Mastercard to make credit card transfers super-simple.

PISP

Some money transfers are enabled by a third-party financial entity called Payment Initiation Service Provider, or PISP, which facilitates direct bank transfers for seamless online transactions.

SWIFT

When funds are processed, payment institutions use Society for Worldwide Interbank Financial Telecommunication (aka SWIFT), a global messaging network that secures and executes cross-border transactions.

Apple Pay

If Apple Pay is enabled on your phone, you can use your mobile wallet to send money abroad with Apple Pay. It’s quick and easy but check with your bank first in case they charge you extra fees. TransferGo doesn’t offer Apple Pay transfers at the moment—but we’re planning to.

Google Pay

You can also send money to friends and family abroad using Google Pay if mobile wallet is set up on your Android. All you need is your receiver’s mobile number. Google Pay transfers isn’t a functionality TransferGo offers at the moment—but watch this space.

Frequently asked questions

What is an international money transfer?

An international money transfer is a financial transaction that sends money from one country to another. It can be done in various ways, speeds and methods with each method carrying different fees, transfer speeds and exchange rates. Reasons for sending an international money transfer online can be anything from sending money to family or friends or paying for goods and services.

International money transfers can be done through traditional banks or online money transfer services such as TransferGo. We offer both fast and fair personal money transfers and affordable and reliable international business payments for business users.

How is TransferGo regulated?

We’re closely regulated by EU and UK law and we work closely with international law enforcement to spot and prevent money laundering, and to keep our 7 million customers safe. End-to-end encryption also protects our customers’ money and data.

Should a transfer ever fail (it’s unlikely), special safeguarding measures ensure that everyone gets their money back.

How can I avoid a wire transfer fee?

If you’re tired of hefty wire transfer fees set by banks, online transfer services like TransferGo offer a more cost-effective solution and are one of the cheapest ways to transfer money internationally. In fact, your first two money transfers abroad with TransferGo are free! After that, we keep the fees low.

The cost of sending money abroad with TransferGo depends on your chosen transfer method. Bank transfers are usually the cheapest international money transfer method but they can take a little longer. Meanwhile, card transfers are instant but come with a slightly higher (but still very low) transfer fee. When compared to other transfer providers, TransferGo proves to be one of the best international money transfer companies and one of the best ways to send a cheap money transfer abroad.

Find out more about how TransferGo works here.

How do I send money overseas to an online bank account?

If you’re sending from a credit/debit card including Visa and Mastercard, just use the TransferGo app to send money to bank account number in the UK. Choose the currency you’re sending from and to, your receiver’s full name and card details, and then add your own details and additional information.

If you’re sending money to the UK via bank, start your order in the TransferGo app, then use your own banking app to send TransferGo the money—using the bank deposit details they send you. Once that’s done, let TransferGo know in the app that you’ve made your bank transfer, and they’ll send money to your recipient’s bank account.

How do I send money internationally with the TransferGo App?

It’s simple. Download the TransferGo app, register your identity, and then follow the prompts. You can download the TransferGo app for iOS, Android and Huawei from the App Store, Google Play and Huawei Gallery. You can also register online using your computer, if you prefer. Transfers via our app are available 24/7.

Psst… did you know that you can also earn money every time you refer a friend to TransferGo? Find out more about our ‘Refer a Friend’ programme here.

What is the best way to transfer money internationally?

Real-time money transfers with a mobile app are the fastest, easiest and best way to transfer money internationally and send money overseas. Most of them are free to download, and are up to 90% cheaper than banks. Some apps, like TransferGo, have outstanding Customer Service in several languages for when users need support.

How long does an international money transfer take?

Our transfers are one of the fastest ways to send money abroad online! But the exact transfer time depends on your transfer delivery method.

Bank to bank transfers take a little longer than card transfers but they’re generally more cost-effective. Meanwhile, card transfers are fast international money transfers and usually arrive within a few minutes but you’ll have to pay a higher (but still very low) fee for this. No matter which method you choose, we’ll make sure your money arrives on time and you’re getting the most competitive price on the market for your fast money transfer abroad.

How do I send money internationally online?

You can send money internationally online using TransferGo. Our transfers are fast, easy and convenient and your first two instant transfers are free!

If you’re sending from a credit/debit card, just use the TransferGo app to send money to a card or bank account abroad. Choose the currency you’re sending from and to, your receiver’s full name and card details, and then your own details. If you’re making a bank transfer, start your order in the TransferGo app, then use your own banking app to send TransferGo the money—using the bank details they send you. Once you’ve done that, let TransferGo know in the app, and they’ll send the money to your receiver.

Don’t know your recipient’s bank details? Simply send us their phone number and we’ll send them a link.

How much can I send abroad? Are there limits on the amount of money I can send abroad?

Different restrictions apply to different countries. But generally, the most you can send abroad in one transaction is around USD 2,500 (or equivalent).

How can I track my money transfer?

After you’ve made a money transfer, you can check your transfer status in your own profile by clicking on the ‘Home’ button. Your transfers will be marked as either ‘In progress’ or ‘Completed’.

What details and documents are needed for sending money abroad?

When you send money worldwide with TransferGo, we’ll usually ask you to verify your identity (don’t worry, this won’t take long). Acceptable ID documents include international passports, National ID cards issued in the EU/EEA, driving licenses issued in the United Kingdom or Turkey, residence permits for residents of Turkey and Lithuania and domestic Ukrainian passports. All ID documents need to be valid and in date.

You’ll also need your card or bank details ready to pay for your transfer.