Send money to the Philippines faster, and for less.

Download our app to send money to the Philippines in minutes.

Send from

Exchange Rate

– – –

GBP 1 = NGN 2030.28232

Transfer Fee

Free – – – 0.99 0.99 USD

Receiver gets

Powered by Moka United

Delivered in minutes

Multi-currency account.

More than just money transfers

Our multi-currency account has landed—a free-to-use platform from which you can send, receive, hold and exchange a range of currencies. With exclusive in-app FX rates and instant, zero-fee transfers between accounts, it’s set to make your money go even further.

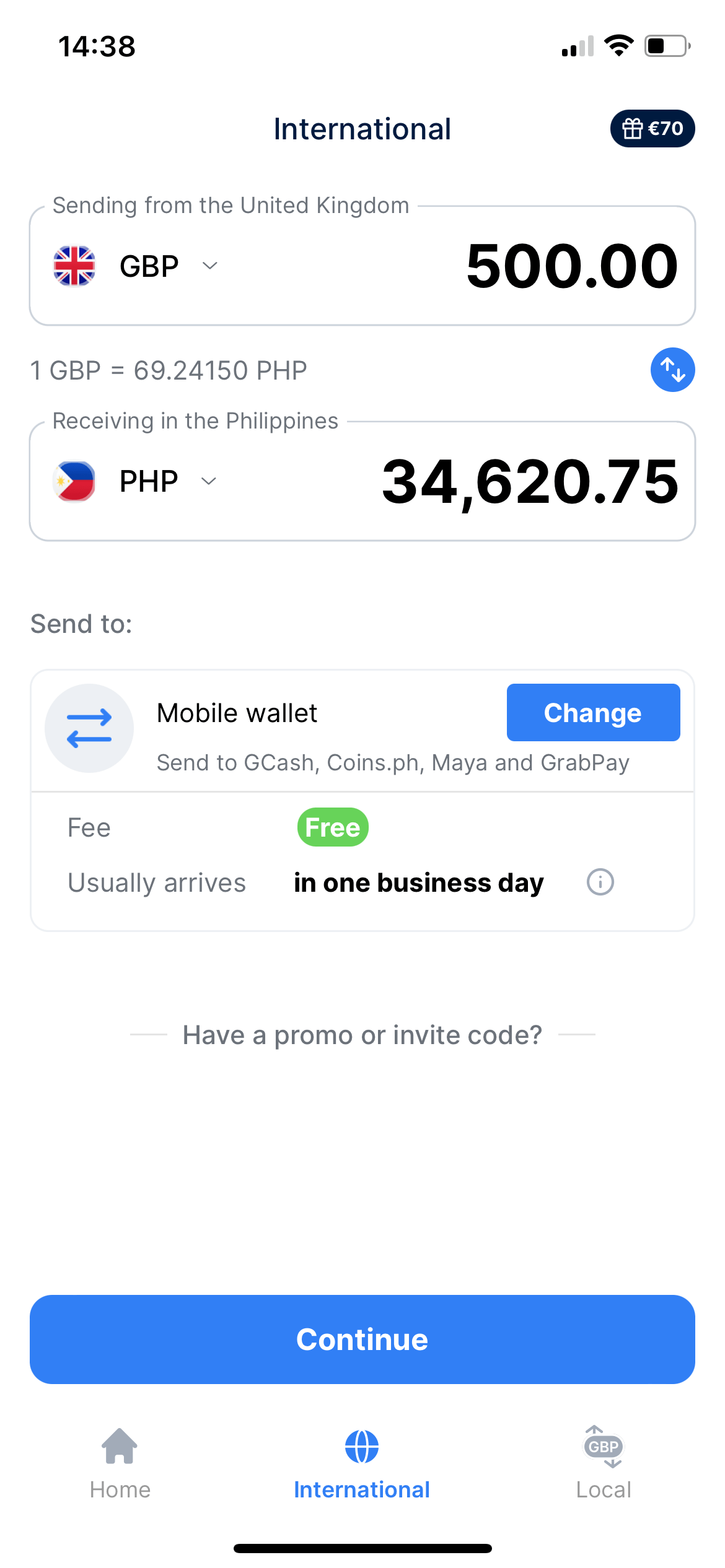

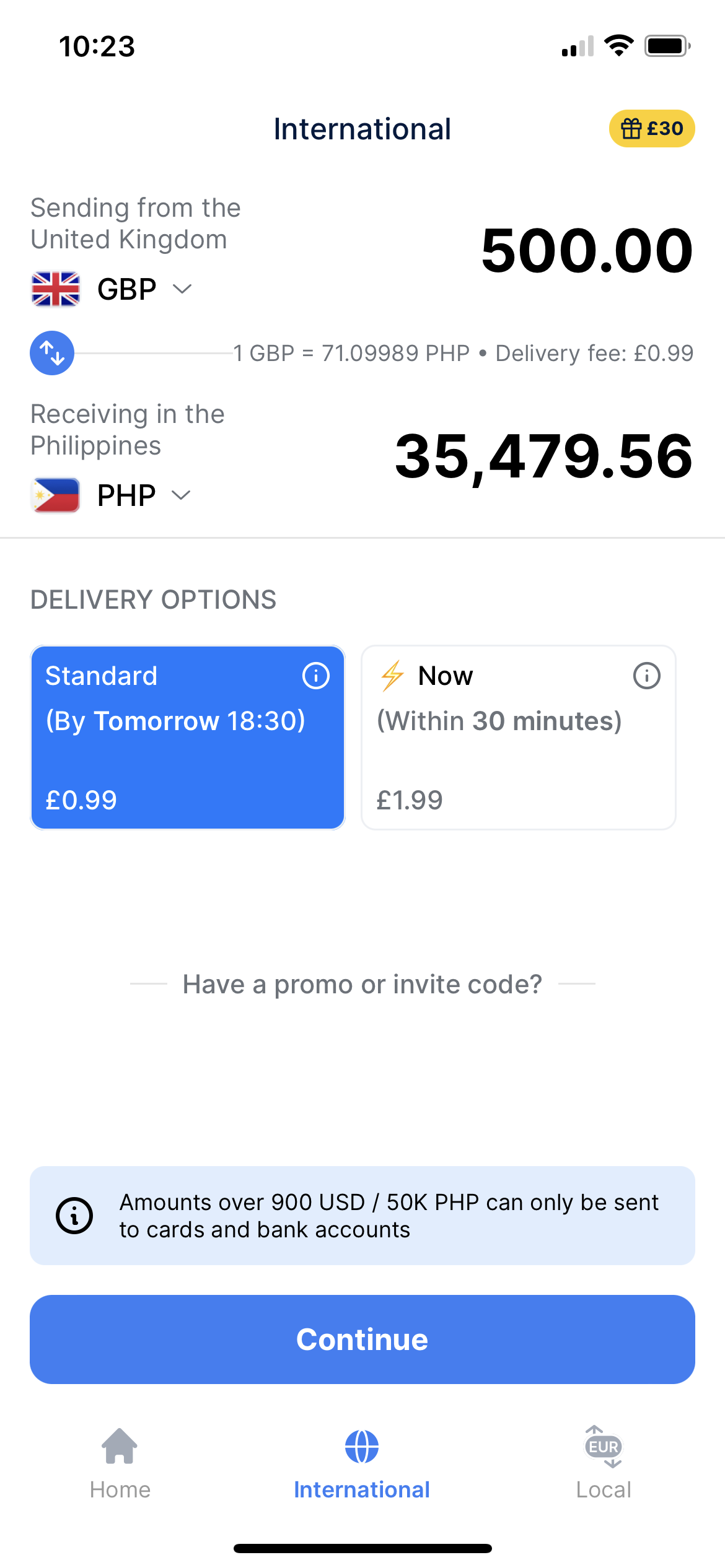

Here’s how much it costs to send money to the Philippines

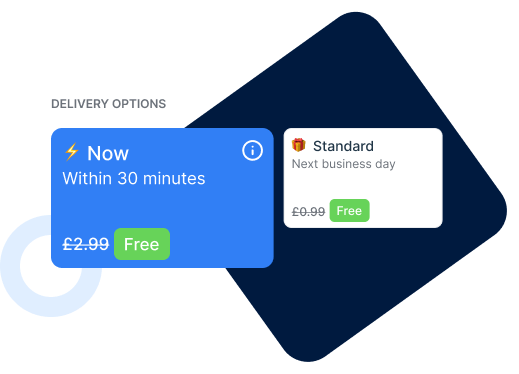

We charge a flat transfer fee for all transfers to the Philippines: just 0.99 (GBP or EUR) for a next-day transfer, and 1.99 for an instant transfer. The receiver gets the exact amount that our app tells you they’ll get. No hidden fees, no nasty surprises.

Download TransferGo app:

Scan to download the TransferGo app

How does your money arrive in the Philippines?

Bank accounts

We make local transfers directly from our Philippines account to your receiver’s bank account, skipping expensive international fees.

Debit/credit card

Or we can put the money straight onto your receiver’s credit card or debit card.

Mobile wallets

We can also top up your receiver’s mobile wallet with USD or PHP—we just need their phone number.

It’s as easy as 1, 2, 3

1

Choose how much you want to send, and when

Send EUR and GBP to PHP and USD in the Philippines

2

Add the receiver’s details.

All you need is your receiver’s full name and account details

3

Choose your payment method—and make the transfer!

Pay in by bank transfer or by card, and your transfer is on its way!

Rest assured

Here’s why you can trust us with sending your money to the Philippines

The cheapest way to make real-time money transfers

Pay family, friends and bills back home— whichever way you suits you best.

How to get started…

What information do I need to make money transfers to the Philippines?

How long does it take to send money to the Philippines?

You can make instant transfers, which usually arrive in 2-3 minutes—or choose our ‘Standard’ option to get your money there the next day.

Send money on the go—Download our app

Scan to download the TransferGo app

Best ways to send money to the Philippines

Bank transfer

Bank transfers are a popular option for funding your international money transfer. They take a little longer than debit or credit card transfers but they’re insanely cheap.

Debit card

Paying with a debit card makes your money transfer super-fast. However, compared to a bank transfer, it can be more expensive as they’re charged at a higher (but still low) fee.

Credit card

You can also pay for your international money transfers with a credit card. TransferGo accepts both Visa and Mastercard to make transfers super simple.

PISP

Some money transfers are enabled by a third-party financial entity called Payment Initiation Service Provider, or PISP, which facilitates direct bank transfers for seamless online transactions.

SWIFT

When funds are processed, payment institutions use Society for Worldwide Interbank Financial Telecommunication (aka SWIFT), a global messaging network that secures and executes cross-border transactions.

Apple Pay

If Apple Pay is enabled on your phone, you can use your mobile wallet to send money to certain countries. It’s quick and easy but check with your bank first in case they charge you extra fees. TransferGo doesn’t offer this functionality at the moment—but we’re planning to.

Google Pay

You can also send money to certain countries using Google Pay if mobile wallet is set up on your Android. All you need is your receiver’s mobile number. This isn’t a functionality TransferGo offers at the moment—but watch this space.

Frequently asked questions (FAQs)

What’s the best way to transfer money to the Philippines?

Real time money transfers with a mobile app are the fastest, easiest way to send money to the Philippines (or any destination country around the world). Most of them are free to download, and are up to 90% cheaper than banks. Some money transfer service apps, like TransferGo, have outstanding Customer Service in several languages for when users need support.

How do I send money from Europe to the Philippines?

If you’re sending from a credit/debit card, you just use the TransferGo app to send money to a card or bank account in the Philippines. Choose the currency you’re sending from and to, your receiver’s full name and card details, and then your own details.

If you’re making a bank transfer, start your order in the TransferGo app, then use your own banking app to send TransferGo the money—using the bank details they send you. Once you’ve done that, let TransferGo know in the app, and they’ll send the money to your receiver in the Philippines.

How to send money to the Philippines electronically?

All you need is an app on your phone to make electronic transfers to the Philippines. TransferGo will send money from your phone or web browser straight to cards, account numbers and mobile wallets in the Philippines—instantly, or on the next day, you decide. You also have different payment options available: you can pay with a card, or from your bank account.

What is the best app to send money to the Philippines?

With a rating of ‘Excellent’ from over 30,000 reviews on Trustpilot, the TransferGo app is highly recommended by users around the world. You can download it for iOS, Android and Huawei from the App Store, Google Play and Huawei Gallery.

What is the cheapest way to send money to the Philippines?

TransferGo’s ‘standard’ delivery method, which gets your money to the Philippines in one working day, costs just 0.99 (EUR or GBP, depending on where you’re sending it from). It costs just 1.99 to send it instantly to a card or mobile wallet, however much you’re sending. Either way, the total cost is not a percentage fee of the total, and as low as possible.

TransferGo’s payment services also save you money on the currency exchange, with good rates sending GBP and EUR to dollar and Philippine Peso accounts back home.

Can I send money to the Philippines through a bank?

Yes, you can, but it’s cheaper to use TransferGo—even if you’re sending from your bank account. Why? Because with TransferGo, your money doesn’t actually cross borders. You make a bank deposit to our account in the United Kingdom, and TransferGo pays your receiver from a TransferGo account in the Philippines. This can save up to 90% on traditional bank transfer fees.

With TransferGo you can also send money from one card straight to another in the Philippines, and it’s almost instant. The functionality is extremely intuitive and allows you to complete transfers in under a minute.

What are the advantages of sending money to the Philippines with TransferGo?

TransferGo’s international money transfers are low cost, and can be performed in a few simple steps without the hassle of visiting a bank. Compared with other digital money transfer apps, TransferGo is cheaper and always has favourable currency exchange rates. They also have fast, friendly Customer Support in English and 9 other languages, which provides guidance and peace of mind when you need it.

Is it safe to send money to the Philippines online?

Online money transfers are safe, as long as:

1) You use a safe and protected money transfer providers like TransferGo. Established money transfer companies are regulated by EU and UK laws, and use the highest possible security to keep your money safe. If transfers ever do get cancelled, they’ll return your money to you immediately.

2) You only send money to people you know and trust. Once your money has been sent to someone, no one can get it back. So beware of fraudsters and be sure of who you’re sending money to.

How can I know which money transfer companies to trust?

Look for well established brands that have proper websites, terms and conditions, and tens of thousands of Trustpilot reviews. For example, TransferGo has over 30,000 verified reviews and a total score of 4.8 out of 5 on Trustpilot, which lets you know that the company is legitimate. TransferGo is also regulated by the Financial Conduct Authority (or FCA) You can also check to see if they partner with established brands, like Visa and Mastercard, Maya, GCash

How long will my money transfer take to arrive in the Philippines?

The delivery time depends on which delivery method you choose. If you choose ‘Instant’, the money will arrive in under 30 minutes—usually, the transfer time is 2 or 3 minutes max. If you choose ‘Standard’, the money will arrive within one working day.

How will my recipient get the money in the Philippines?

You can send money to your recipient’s bank account, credit cards, debit cards and mobile wallets. You just need to enter the appropriate details when you make the transfer.