Convenient. Instant. Yours.

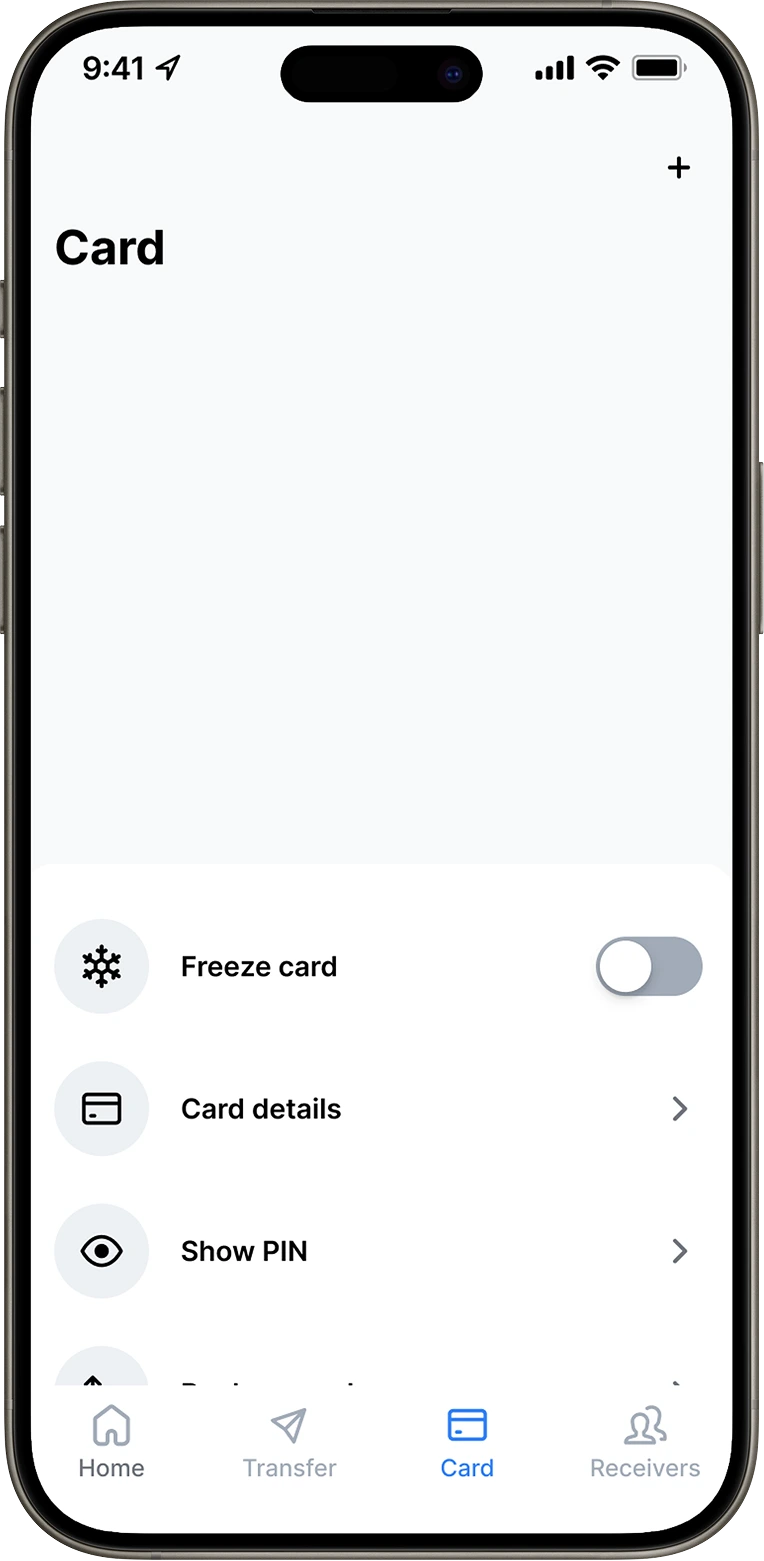

The virtual debit card

A card that’s secure, easy to use, and won’t cost you a thing.

Scan to download the TransferGo app

Currently only available in the UK—more countries coming soon.

Go further, spend freely

More ways to spend

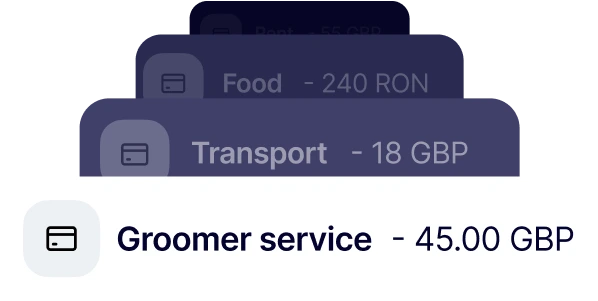

Linked to your TransferGo GBP Account and designed for secure online spending, you can manage your virtual card through our mobile app.

1

Spend globally with no hidden costs

Confirm your ID and choose your plan

2

Top up

balances via bank transfer

Get a virtual card instantly or a physical one delivered fast

3

Smart spending insights

Top up your account and start spending

Scan to download the TransferGo app

Why go virtual?

A virtual debit card gives you instant access, secure spending, and the freedom to shop online globally. It’s fast, safe, and always with you.

Get your card quickly, for free

No monthly subscription fees

Great for online shopping

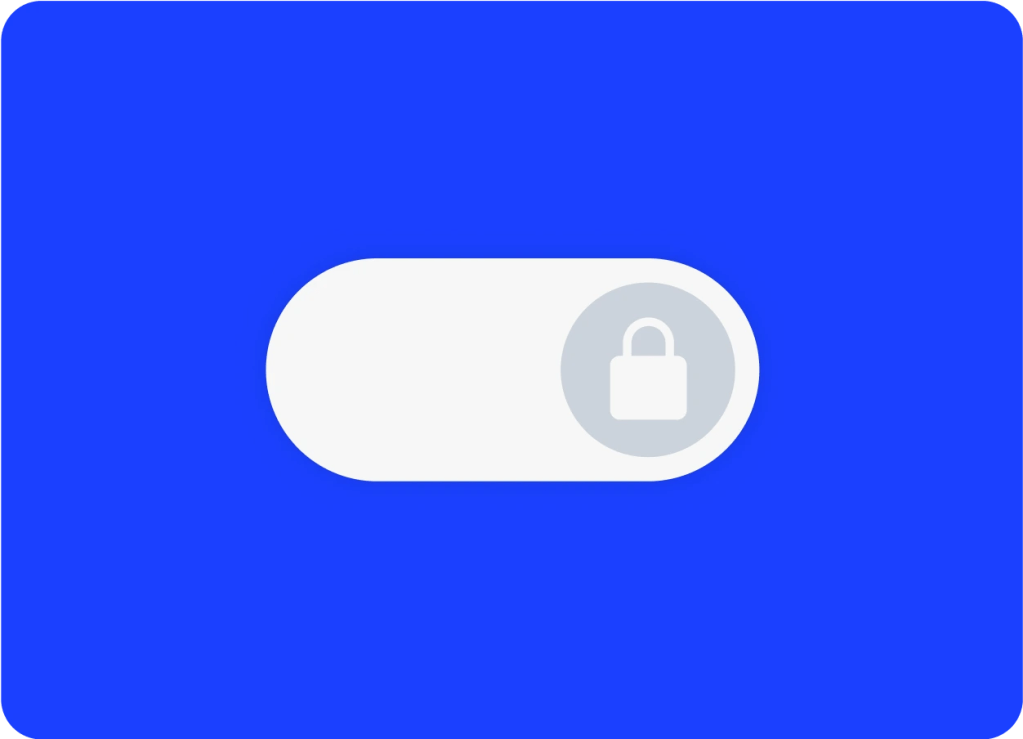

Instantly freeze/unfreeze your card

Safe and secure

Scan to download the TransferGo app

Unlock secure, smart spending

Download the TransferGo app and get your free card in minutes

1

Verify

Confirm your ID

2

Order

Get a virtual card instantly

3

Enjoy

Top up your account and start spending

Scan to download the TransferGo app

Pick the card

that suits your needs

ESSENTIAL

FREE

Everything you need for secure, everyday spending—fast money transfers, a digital debit card for international use, and a multi-currency account.

GBP virtual VISA debit card

Send, receive, hold and exchange GBP, EUR or PLN

Top up balances via bank transfer or card

Spend worldwide with no hidden costs

EXTRA

£4.99/Monthly

Free until early 2026!

Everything in the Essential Plan, plus:

New to the UK? Get a physical card that’s easy to set up, with free ATM withdrawals, priority customer support, faster transfers, and lower fees.

GBP physical Visa debit card

ATM withdrawals (UK & EEA): £500 free/month (up to 3 withdrawals), then 1.5% (min £1)

ATM withdrawals (Rest of World): £200 free/month (up to 3 withdrawals), then 3% (min £1)

Priority Customer Support

Overview

Card type

Currencies

Top-up options

Coverage

ATM withdrawals

ESSENTIAL

FREE

Keep it simple with fast money transfers, a secure digital debit card, and smart online spending with no hidden fees.

Virtual GBP Visa debit card

Send, receive, hold, and exchange GBP, EUR or PLN

Bank transfer

Worldwide, no hidden costs

Not included

EXTRA

£4.99/Monthly

Free until early 2026!

Everything in Essential, plus faster transfers, lower fees, priority support, physical and virtual card, and free global ATM withdrawals.

Physical + virtual GBP Visa debit card

✅

✅

✅

– UK & EEA: £500 free (up to 3 withdrawals per month), then 1.5% fee (min £1)

– Rest of World: £200 free (up to 3 withdrawals per month), then 3% fee (min £1)

COMING SOON

Smarter plans and exciting features are coming your way very soon! Sign up for updates you won’t want to miss.

Frequently asked questions

What is the TransferGo virtual Visa debit card?

The TransferGo Virtual Visa debit card is a digital Visa card linked to your TransferGo GBP Account. Perfect for secure online spending, receiving payments, and sending money.

How can I get a TransferGo virtual Visa debit card?

Simply sign in to your TransferGo app, confirm your identity, and follow the steps to request your virtual card. It’s free and available instantly—no waiting required.

How do I use my virtual debit card for online payments?

You can use your virtual card just like a regular debit card. At checkout, enter your card number, expiry date, and CVV—found in your app. It’s secure, fast, and works anywhere Visa is accepted online.

How can I withdraw money using the virtual debit card?

Virtual cards can’t be used at ATMs. To withdraw cash, you’ll need to order a physical TransferGo debit card through the app, which offers fast delivery and even more benefits.

How does the TransferGo virtual Visa debit card work?

Once activated, your virtual debit card is linked to your GBP balance in your TransferGo multi-currency account. You can spend online, receive payments, send money, and manage everything from your app.

How do I add money to my virtual debit card?

Top up your card by adding funds to your TransferGo multi-currency account via bank transfer. Once your balance is funded, your virtual card will be ready to use immediately.

This card service is issued by B4B payments pursuant to license with Visa, who acts as a data processor for specific operations such as card personalisation and delivery. For more details, please read B4B’s Privacy Policy and the TransferGo Privacy Policy.