Here for the

Moments that matter

Here for…

Money that knows no bounds

Make high-speed, low-cost payments to over 160 countries.

Send from

Exchange Rate

– – –

GBP 1 = NGN 2030.28232

Transfer Fee

Free – – – 0.99 0.99 USD

Receiver gets

Powered by Moka United

Delivered in minutes

Rated — Excellent

From reviews on Trustpilot

For You

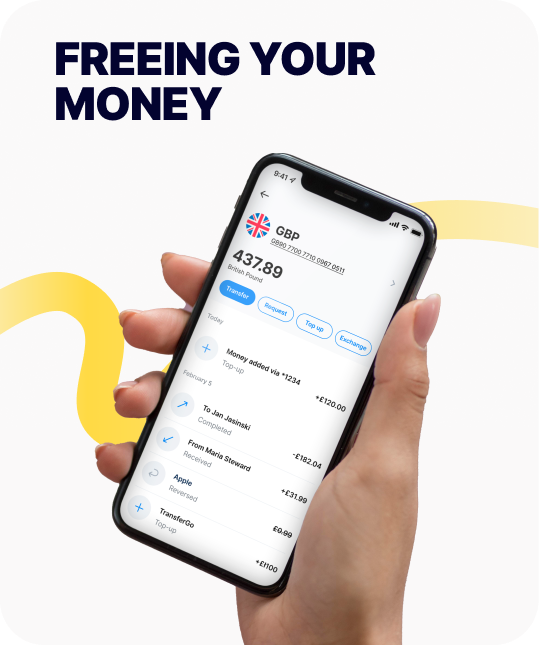

Do everything—from sending and receiving payments to managing and exchanging currencies—all in one app.

Scan to download the TransferGo app

Send

Send money home quickly, securely, and with no hidden fees. With great rates and transfers you can trust, supporting loved ones back home has never been easier.

MANAGE

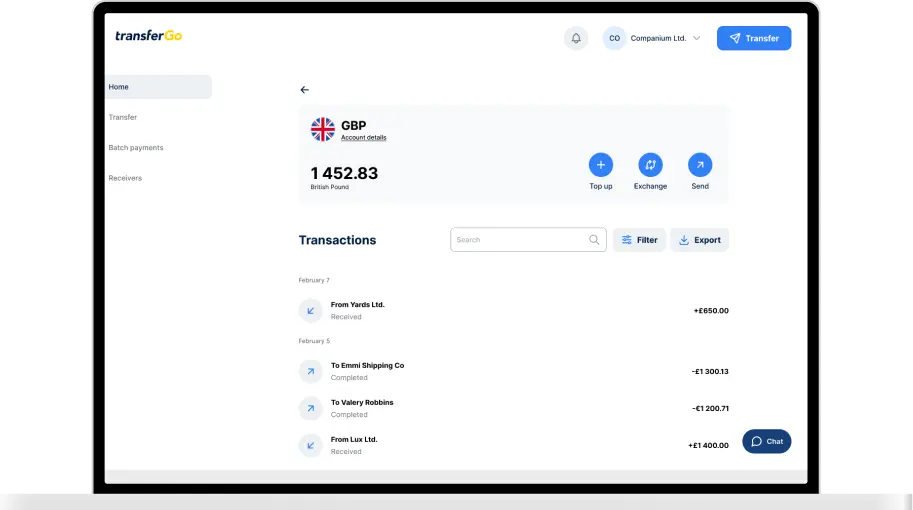

Keep everything in one place. Hold and exchange multiple currencies, track your transfers, and manage your account seamlessly—all from the app.

SPEND

Spend with confidence, at home or abroad. With your GoCard, you can shop, withdraw cash, and keep your money within reach wherever life takes you.

For your business

Save on every international transaction with TransferGo Business—a simple-to-use platform designed to grow profits and global reach.

Pick the card

that suits your needs

VIRTUAL GOCARD

FREE

Everything you need for secure, everyday spending and fast money transfers. A virtual GoCard for international use, and a multi-currency account.

GBP virtual Visa debit card

Send, receive, hold and exchange GBP, EUR or PLN

Top up balances via bank transfer or card

Spend worldwide with no hidden costs

PHYSICAL GOCARD

£4.99 one-time payment

New to the UK? Get a physical GoCard that’s easy to set up, with free ATM withdrawals, priority customer support, faster transfers, and lower fees.

GBP physical Visa debit card

ATM withdrawals (UK & EEA): £500 free/month (up to 3 withdrawals), then 1.5% (min £1)

ATM withdrawals (Rest of World): £200 free/month (up to 3 withdrawals), then 3% (min £1)

Priority Customer Support

Overview

Card type

Currencies

Top-up options

Coverage

ATM withdrawals

VIRTUAL

GOCARD

FREE

Keep it simple with fast money transfers, a secure virtual GoCard, and smart online spending with no hidden fees.

Virtual GBP Visa debit card

Send, receive, hold, and exchange GBP, EUR or PLN

Bank transfer

Worldwide, no hidden costs

Not included

PHYSICAL GOCARD

£4.99 one-time payment

Everything in virtual, plus faster transfers, lower fees, priority support, physical and virtual GoCard, and free global ATM withdrawals.

Physical + virtual GBP Visa debit card

✅ (Included)

✅ (Included)

✅ (Included)

– UK & EEA: £500 free (up to 3 withdrawals per month), then 1.5% fee (min £1)

– Rest of World: £200 free (up to 3 withdrawals per month), then 3% fee (min £1)

COMING SOON

Smarter plans and exciting features are coming your way very soon! Sign up for updates you won’t want to miss.

Frequently asked questions

What is TransferGo?

TransferGo is a digital money service that aims to improve the lives of hard-working people through simpler, better financial services. It began with developing fast, cheap international money transfers, and is now spreading out its offering to remove barriers for customers, especially migrants, who need financial services.

Is TransferGo safe?

TransferGo is closely regulated by EU and UK law. We work closely with international law enforcement to spot and prevent money laundering, and to keep our 9 million customers and their money safe.

Our end-to-end encryption protects our customers’ money and data. Should a transfer ever fail, there are special safeguarding measures in place to ensure that everyone gets their money back.

Of course, customers must still look out for fraud and stay safe online. As with all fraud, once the money has been sent, it’s very hard to get it back.

Can I trust TransferGo?

Millions of users around the world trust TransferGo with their money. With a rating of ‘Excellent’ from over 35,000 reviews on Trustpilot, the TransferGo app is highly recommended by customers. It also helps that TransferGo has excellent Customer Service in English and 9 other languages.

How does TransferGo work?

Years ago, TransferGo found an elegant solution to the problem of expensive international transfers.

By opening bank accounts in each country we served, we could use local transfers only to receive money in the send country, and to send money in the receiving country. Local transfers at both ends allowed us to cut out almost all of the costs, and pass the savings on to our customers. That’s why TransferGo rates are famously low. Now that fintech infrastructure has grown so much, we have more transfer options now than we did then, with superfast card-to-card payments, payments to e-wallets, and even cash transfers. But whatever the format, we’re always trying to make it as affordable as we can for our customers—while ensuring the transfers are secure and on time.

How to use TransferGo

It’s simple. Download the TransferGo app, register your identity, and then follow the prompts. You can download the TransferGo app for iOS, Android and Huawei from the App Store, Google Play and Huawei Gallery. You can also register online using your computer, if you prefer.

How to send money with TransferGo

The first step is your TransferGo verification: proving your identity so we can keep you and your money safe. After that, you simply choose the currency and amount that you’re sending, and the details of the person you’re sending it to. Finally, you choose how you want to pay for the transfer—and that’s how to transfer money with TransferGo!

This card service is issued by B4B payments pursuant to license with Visa, who acts as a data processor for specific operations such as card personalisation and delivery. For more details, please read B4B’s Privacy Policy and the TransferGo Privacy Policy.